ASTR Coin: The Newcomer Shaking Up the DeFi Market

Amidst the roar of rising gold prices, the crypto world is abuzz with its own excitement. A new coin called Astar (ASTR), developed by the team behind the Astar Network, has recently captured significant attention, touted as a serious competitor to the decentralized derivatives giant, Hyperliquid.

Why Is ASTR Considered a Hyperliquid Competitor?

To understand ASTR’s potential, we need to look at what has made Hyperliquid so dominant in the decentralized perpetual futures market: speed, efficiency, and deep liquidity. Hyperliquid has successfully offered a trading experience similar to a centralized exchange (CEX) but with the key advantages of decentralization, thanks to its unique architecture.

Now, ASTR arrives on the scene with several claims and features that directly challenge that dominance:

- Multi-Chain Support: Unlike Hyperliquid, which operates on a single blockchain, Astar Network is designed to be a smart contract hub compatible with multiple blockchains. This means that ASTR is not limited to one ecosystem but can reach and integrate liquidity from various chains, such as Ethereum, BNB Chain, and Arbitrum. This flexibility is a major draw for traders who want to capitalize on opportunities across different platforms without needing to move assets constantly.

- Support from Key Figures: The ASTR coin received massive spotlight after gaining support from influential figures in the crypto industry, including former Binance CEO, Changpeng “CZ” Zhao, and Binance Labs. This backing provides significant validation and trust for investors, triggering a fantastic surge in interest and trading volume right from its launch.

- Focus on User Experience (UX): Astar is working to offer features that appeal to retail traders, such as a large-scale airdrop mechanism to encourage adoption and MEV-free trading features that guarantee transactions without manipulation from miners or validators. This creates a fairer and more appealing trading environment, which could attract a much broader user base compared to Hyperliquid, which tends to be more focused on professional traders.

Hyperliquid vs. Astar: A Fierce Battle

Although ASTR shows great potential, Hyperliquid is not an opponent to be underestimated. Hyperliquid has built a strong foundation with a much larger market cap and stable daily trading volume. The platform is already widely known as a reliable solution for decentralized derivatives trading.

The battle between the two can be summarized as “a fight between the stable giant and the agile newcomer.”

- Hyperliquid (HYPE): Offers stability, deep liquidity, and a solid reputation. The platform is ideal for professional traders seeking fast execution and high leverage.

- Astar (ASTR): Sells the promise of multi-chain flexibility and community-driven adoption, backed by support from prominent figures. This appeals to traders looking for explosive growth opportunities and who want to be involved in a fast-growing project.

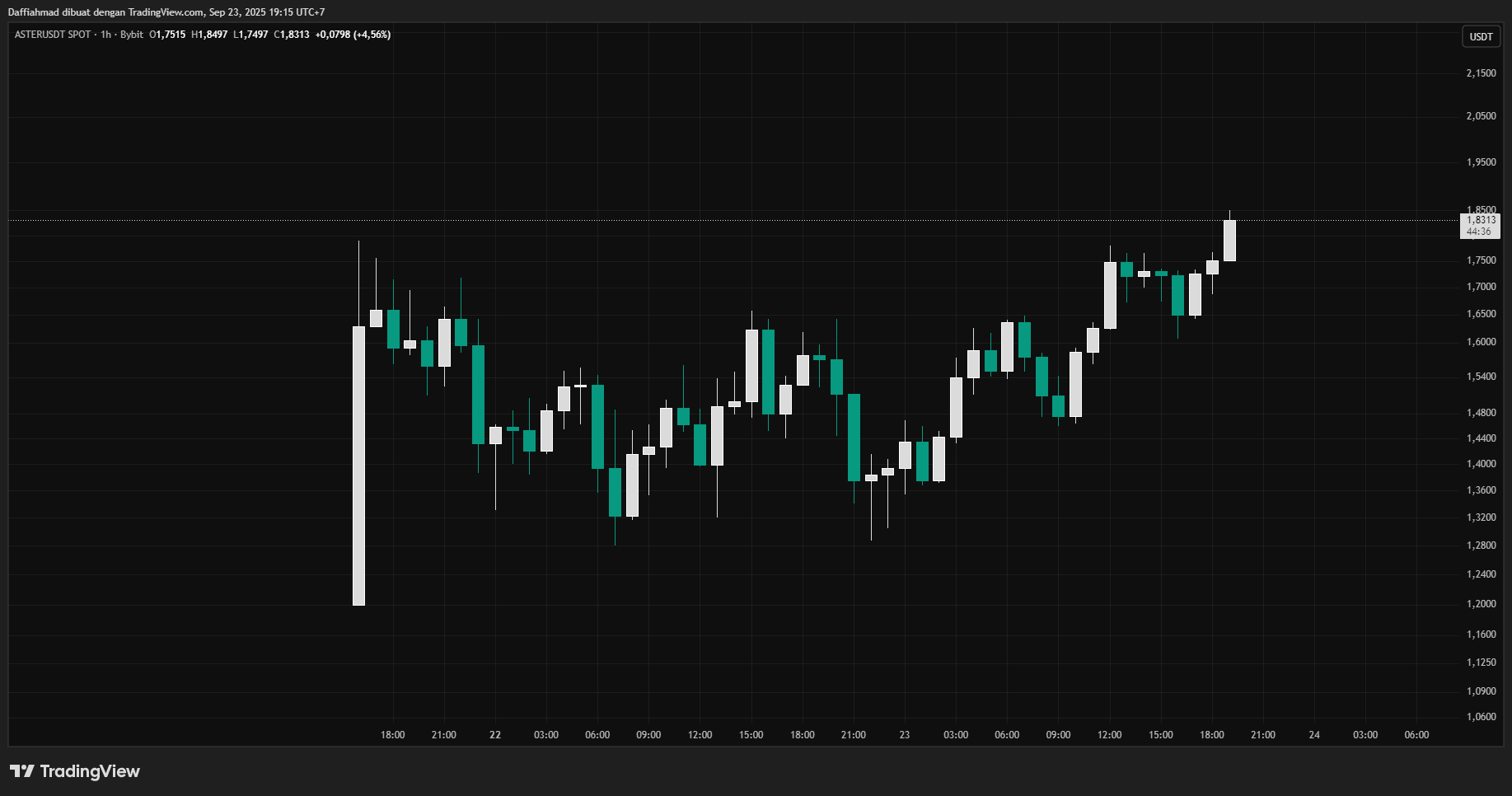

The crypto market is currently witnessing an exciting competition in the decentralized finance sector. Can ASTR live up to the expectations and truly rival Hyperliquid’s dominance? The future price movements and trading volume of ASTR will be the key indicators to answer that question.