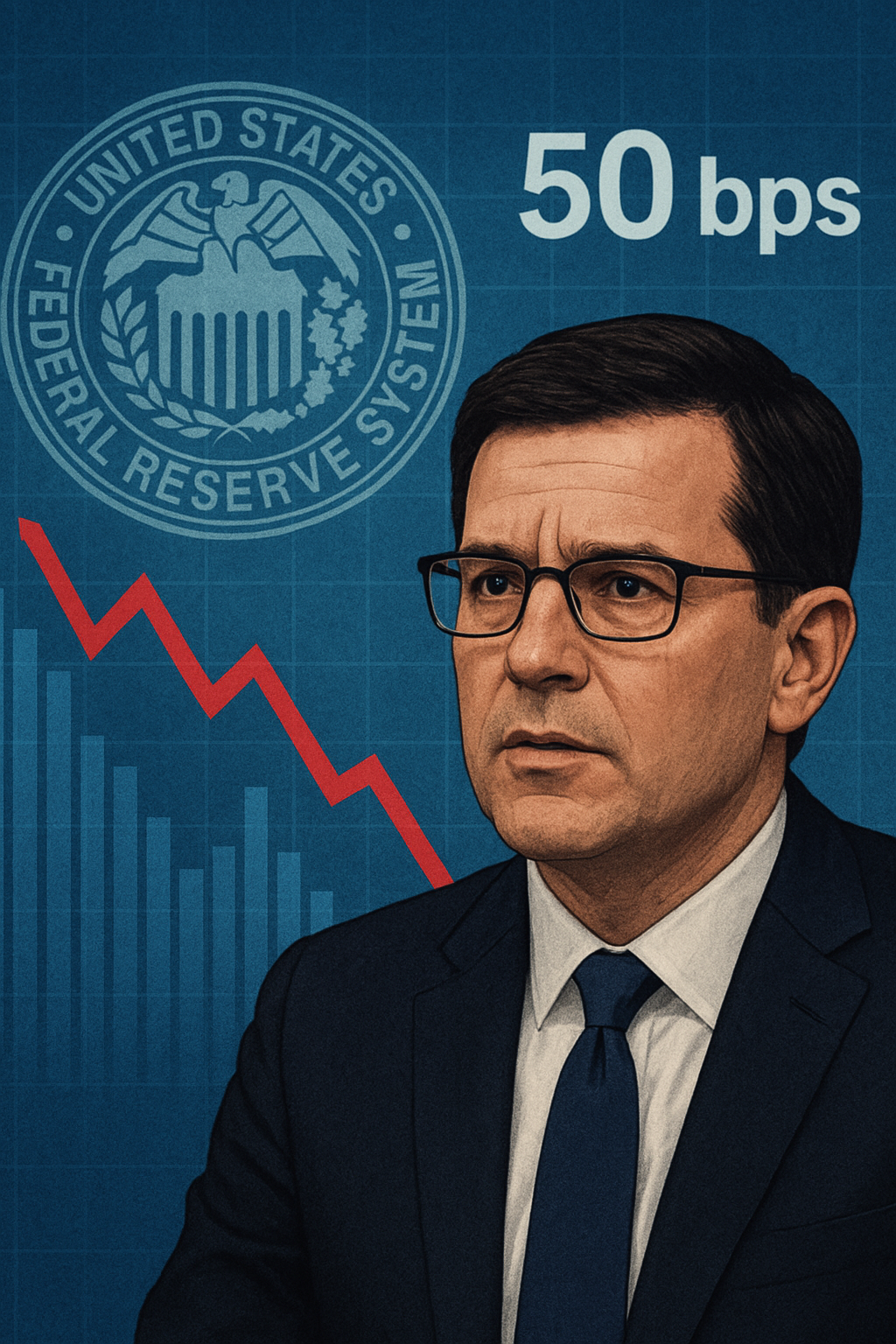

📝 Federal Reserve Governor Stephen Miran calls for a 50-basis-point adjustment, warning current rates are too restrictive. Discover why this bold stance matters for markets, jobs, and inflation expectations.

Introduction

In a striking move, Federal Reserve Governor Stephen Miran has publicly argued for a 50-basis-point (bps) policy shift, claiming the current federal funds rate is far too restrictive. His stance stands out in a central bank known for its gradual 25-bps adjustments.

Why Miran Supports a 50 bps Move

- Current Policy Is Too Tight: Miran says the neutral rate is now much lower than the Fed’s policy rate. Holding rates high risks unnecessary layoffs and weakens investment.

- Neutral Rate Is Falling: Immigration policies, tariffs, and fiscal rules are reshaping the U.S. economy, reducing the neutral rate and requiring a softer stance from the Fed.

- Dissent Within the FOMC: Miran is currently the only official calling for 50 bps, but his reasoning highlights a growing debate about the right pace of rate cuts.

Potential Market Impacts

|

Area |

Possible Effect |

|

Interest Rates & Liquidity |

A 50 bps cut would lower borrowing costs, supporting credit growth. |

|

Labor Market |

Could reduce layoffs and support wage growth. |

|

Inflation Expectations |

Might risk higher inflation if easing is too aggressive. |

| Financial Assets |

Bond yields could fall, equity markets might rally. |

Criticism of Miran’s Approach

- Risk of Overheating: Cutting too much, too fast could spark inflation again.

- Fed Credibility: The Fed usually moves gradually; a 50 bps change may unsettle markets.

- Neutral Rate Debate: Estimates vary widely, so Miran’s thesis may prove too optimistic.

Looking Ahead

Miran’s 50-bps stance has injected new tension into U.S. monetary policy. Investors will closely watch upcoming FOMC meetings to see whether the central bank warms to his argument or sticks to a slower pace of cuts.

Key Takeaways

- Miran wants the Fed to cut rates by 50 bps instead of 25 bps.

- He believes the neutral rate is falling due to structural changes.

- A bold move could ease credit conditions but carries inflation risk.